Carrying our mission forward to present the above Loss of Profit insurance (as it is normally called) in the simplest form, we give you a fair idea of some of the important terms being frequently used in this insurance.

Property Damage Proviso

This provides that there should be a property insurance policy in force and also the property damage insurer have paid or at least admitted liability for the said property damage. The reasons for the introduction of this provision are not far to seek. Firstly, it is not difficult to understand that instead of incorporating the terms or warranties related to Property damage insurance in consequential loss policy; it is much better to have this proviso for fulfillment of the same terms and conditions. Secondly, it is more convenient to have one investigation done for the cause of damage rather than have two separate ones which may lead to

complexities and last but not the least, it is significant for consequential loss insurers to know monies would be available from property damage insurers to enable the insured to speedily reinstate the property thus minimizing the interruption of business.

Adjustment Clause

This makes the consequential loss policy calculate the real indemnity in the truest sense. This also silences the critics of insurance policies that insurers are not rising to the occasion for industry and trade. It is done by incorporating the following wordings. The wordings are explained at length with suitable example.

(1) The trend of the business

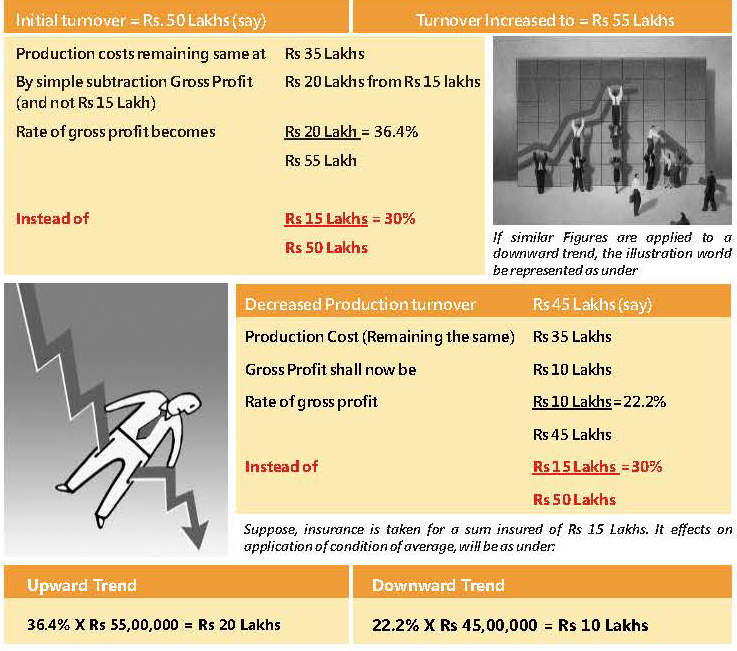

In case the business in question was showing a rising turnover just prior to the fire, the insured should be duly compensated for that trend. Vice-Versa, in case the trend was declining, the true indemnity theory should account for that as well. While calculating the rate of gross profit, it would be therefore essential to accordingly make adjustments. An illustration to this effect would clarify the situation:

It would be therefore be seen that in an upward trend there is an under insurance and in a down ward trend, there is an over insurance. Therefore, care should be taken in selecting and evaluating the sum insured depending upon the correct trend as far as possible.

(2) Variations and Special Circumstances

If no definite trend is available from the books of accounts or some positive trend which has recently happened, then there workings enable the insurer to accordingly adjust for such a trend.

For example, if a firm has just completed installation of additional improved machinery, and it can be shown that, but for the fire, substantially increased turnover would have resulted, and that stocks of raw materials would have been available, and that sale of increased quantity of finished goods could have been achieved then, on the assumption of an adequate insurance to cover the greatly enhanced gross profit anticipated, the company will indemnity the insured accordingly, by operating the adjustment clause to allow for the variation from pre fire trading.

We now give below the steps that are prescribed for calculating the amount payable for a loss in the under mentioned chronological sequence:

Recent Comments